Markowitz Portfolio Optimization

Overview

Markowitz portfolio optimization is a technique that gives the optimal position in a set of investiments to minimize risk with a minimum expected return constraint. This idea is by no means new, as Markowitz introduced the idea in 1952 and was awarded the Nobel prize in 1990 for his work on modern portfolio theory. Markowitz portfolio optimization requires that some statistics about the assests are known: the mean returns and covariance among the assests. It is unclear how to optimally estimate these parameters. When taking the coursera.org course on financial engineering from Columbia, there was a lecture on Markowitz portfolio optimization as well as a homework exercise, but these parameters were given. This positing is not about surveying different estimation techniques, nor proposing any new ones, but is rather an excuse for me to try to improve my python skills.

Gathering The Data

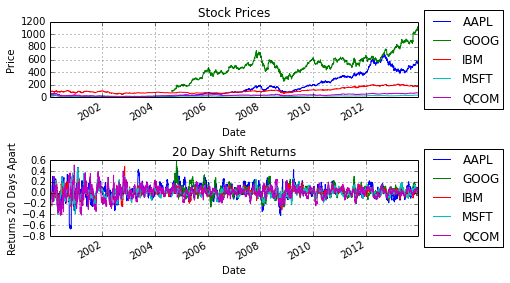

The first step is to get data on our assets. Here, I will be focusing on stocks. To keep things simple, I just selected five stocks: Apple, IBM, Google, Microsoft and Qualcomm. I will also consider a fixed interest rate position with zero risk. The pandas library provides an easy way to get all the stock prices at the close of every business day. The following code will produce a pandas Dataframe object with the daily adjusting closing price of the five stocks from January 1st, 2000 to January 1st, 2014. Since Google was not a publicly traded company during the beginning of this time frame, NaN are filled in. The list comprehension expression to get the data was taken from the book Python for Data Analysis by Wes McKinney.

import pandas as pd

import numpy as np

import pandas.io.data as web

from pandas import Series, DataFrame

StockList = ['AAPL','IBM','MSFT','GOOG','QCOM']

all_data = {}

# For simplicity, assume fixed interest rate

interest_rate = 0.03/12.

# Minimum desired return

rmin = 0.02

for ticker in StockList:

all_data[ticker] = web.get_data_yahoo(ticker,'1/1/2000','1/1/2014')

price = DataFrame({tic: data['Adj Close'] for tic,

data in all_data.iteritems()})

print price.head(10)

AAPL GOOG IBM MSFT QCOM

Date

2000-01-03 26.90 NaN 96.60 42.59 77.19

2000-01-04 24.63 NaN 93.32 41.15 69.77

2000-01-05 24.99 NaN 96.60 41.58 67.35

2000-01-06 22.83 NaN 94.93 40.19 60.30

2000-01-07 23.91 NaN 94.52 40.72 64.57

2000-01-10 23.49 NaN 98.26 41.01 68.61

2000-01-11 22.29 NaN 99.10 39.96 62.18

2000-01-12 20.95 NaN 99.51 38.66 59.52

2000-01-13 23.25 NaN 98.47 39.39 61.62

2000-01-14 24.13 NaN 99.61 41.01 60.46

[10 rows x 5 columns]

Estimating The Parameters

Now that we have the stock data we need to figure out how to compute the required parameters for the Markowitz portfolio optimization: the mean returns and covariance. I also need to pick a time frame to compute these parameters over. In this case, I choose 20 business days. Thus, the first step is to compute the returns 20 days into the future:

# Specify number of days to shift

shift = 20

# Compute returns over the time period specified by shift

shift_returns = price/price.shift(shift) - 1

We could also have used the pandas Dataframe method pct_change with the period set to 20. Now that we have the returns over the period we want, we can compute the mean and covariance. As stated before, the purpose of this exercise is more for me to improve at python and not particularly to do anything advanced, so I opted to use a exponential weighting or an AR-1 model:

# Specify filter "length"

filter_len = shift

shift_returns_mean = pd.ewma(shift_returns,span=filter_len)

shift_returns_var = pd.ewmvar(shift_returns,span=filter_len)

# Compute covariances

NumStocks = len(StockList)

CovSeq = pd.DataFrame()

for FirstStock in np.arange(NumStocks-1):

for SecondStock in np.arange(FirstStock+1,NumStocks):

ColumnTitle = StockList[FirstStock] + '-' + StockList[SecondStock]

CovSeq[ColumnTitle] = pd.ewmcov(

shift_returns[StockList[FirstStock]],

shift_returns[StockList[SecondStock]],

span=filter_len)

To reiterate, I am not claiming this is the best way of estimating the parameters.

Computing The Markowitz Optimal Portfolio

Now that we have the parameters we need, all that is left to do is to compute the optimal Markowitz portfolio. Let $\mathbf{x}$ be the vector describing the proportion of money to put into each assest, $\bar{\mathbf{p}}$ be the vector of mean returns, $\Sigma$ be the covariance matrix and $r_{\min}$ be the minimum expected return that is desired. Having defined those variables, the optimal Markowitz portfolio assuming no short positions is given by the following quadratic program (see Boyd and Vandenberghe)

\begin{align}

&\underset{\mathbf{x}}{\mbox{minimize}} & & \mathbf{x}^{T} \Sigma \mathbf{x} \

& \mbox{subject to} & & \bar{\mathbf{p}}^{T} \mathbf{x} \geq r_{\min} \

& & &\mathbf{1}^{T} \mathbf{x} = 1 \

& & &\mathbf{x} \geq 0

\end{align}

In order to solve this problem, I downloaded the python convex optimization package CVXOPT and then wrote the following class and method:

from cvxopt import matrix, solvers

import numpy as np

def MarkowitzOpt(meanvec,varvec,covvec,irate,rmin):

'''Framework and variable names taken from pg.155 of Boyd and Vandenberghe

CVXOPT setup taken from:

http://cvxopt.org/userguide/coneprog.html#quadratic-programming

http://cvxopt.org/userguide/coneprog.html#quadratic-programming'''

# Number of positions

# Additional position for interest rate

numPOS = meanvec.size+1

# Number of stocks

NumStocks = meanvec.size

# mean return vector

pbar = matrix(irate,(1,numPOS))

pbar[:numPOS-1]=matrix(meanvec)

# Ensure feasability Code

pbar2 = np.array(pbar)

if(pbar2.max() < rmin):

rmin_constraint = irate

else:

rmin_constraint = rmin;

counter = 0

SIGMA = matrix(0.0,(numPOS,numPOS))

for i in np.arange(NumStocks):

for j in np.arange(i,NumStocks):

if i == j:

SIGMA[i,j] = varvec[i]

else:

SIGMA[i,j] = covvec[counter]

SIGMA[j,i] = SIGMA[i,j]

counter+=1

# Generate G matrix and h vector for inequality constraints

G = matrix(0.0,(numPOS+1,numPOS))

h = matrix(0.0,(numPOS+1,1))

h[-1] = -rmin_constraint

for i in np.arange(numPOS):

G[i,i] = -1

G[-1,:] = -pbar

# Generate p matrix and b vector for equality constraints

p = matrix(1.0,(1,numPOS))

b = matrix(1.0)

q = matrix(0.0,(numPOS,1))

# Run convex optimization program

solvers.options['show_progress'] = False

sol=solvers.qp(SIGMA,q,G,h,p,b)

# Solution

xsol = np.array(sol['x'])

dist_sum = xsol.sum()

return xsol

The input variable irate describes the interest rate which is assumed fixed during the duration of the optimizaton period (defined in this example above as 20 business days, however for simplicity I will assume it is fixed for all time). The interest rate is assumed to be a risk free position. The first part of the code creates a new mean vector with the interest rate return appended (note I assumed this value is the expected return for the duration of the optimization but it may be adjusted to account for this period, i.e. the return from interest over an arbitrary duration of time). The next part of the code converts the covariance matrix into the matrix structure required of CVXOPT. Then the quadratic program is put into the cannonical form required of CVXOPT and lastly the optimal position is computed and returned.

Putting It All Together

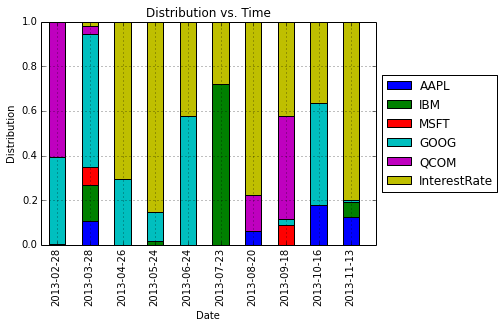

Now that the hard work is done, all that is left to do is actually compute the Markowitz optimal portfolio. I will start optimizing on January 3rd, 2006 (not at the beginning of our data set to allow some time for the means and covariance to stabilize a little), the the portfolio will be reoptimized every 20 business days.

# Variable Initialization

START_DATE = '2006-01-03'

INDEX = shift_returns.index

START_INDEX = INDEX.get_loc(START_DATE)

END_DATE = INDEX[-1]

END_INDEX = INDEX.get_loc(END_DATE)

DATE_INDEX_iter = START_INDEX

StockList.append('InterestRate')

DISTRIBUTION = DataFrame(index=StockList)

RETURNS = Series(index=INDEX)

# Start Value

TOTAL_VALUE = 1.0

RETURNS[INDEX[DATE_INDEX_iter]] = TOTAL_VALUE

while DATE_INDEX_iter + 20 < END_INDEX:

DATEiter = INDEX[DATE_INDEX_iter]

# print DATEiter

xsol = MarkowitzOpt(shift_returns_mean.ix[DATEiter],

shift_returns_var.ix[DATEiter],

CovSeq.ix[DATEiter],interest_rate,rmin)

dist_sum = xsol.sum()

DISTRIBUTION[DATEiter.strftime('%Y-%m-%d')] = xsol

DATEiter2 = INDEX[DATE_INDEX_iter+shift]

temp1 = price.ix[DATEiter2]/price.ix[DATEiter]

temp1.ix[StockList[-1]] = interest_rate+1

temp2 = Series(xsol.ravel(),index=StockList)

TOTAL_VALUE = np.sum(TOTAL_VALUE*temp2*temp1)

# print TOTAL_VALUE

# Increase Date

DATE_INDEX_iter += shift

# print 'Date:' + str(INDEX[DATE_INDEX_iter])

RETURNS[INDEX[DATE_INDEX_iter]] = TOTAL_VALUE

# Remove dates that there are no trades from returns

RETURNS = RETURNS[np.isfinite(RETURNS)]

Lastly, let us plot our results.

import matplotlib.pyplot as plt

%matplotlib inline

temp3 = DISTRIBUTION.T

# To prevent cramped figure, only plotting last 10 periods

ax = temp3.ix[-10:].plot(kind='bar',stacked=True)

plt.ylim([0,1])

plt.xlabel('Date')

plt.ylabel('Distribution')

plt.title('Distribution vs. Time')

ax.legend(loc='center left', bbox_to_anchor=(1, 0.5))

fig, axes = plt.subplots(nrows=2,ncols=1)

price.plot(ax=axes[0])

shift_returns.plot(ax=axes[1])

axes[0].set_title('Stock Prices')

axes[0].set_xlabel('Date')

axes[0].set_ylabel('Price')

axes[0].legend(loc='center left', bbox_to_anchor=(1, 0.5))

axes[1].set_title(str(shift)+ ' Day Shift Returns')

axes[1].set_xlabel('Date')

axes[1].set_ylabel('Returns ' + str(shift) + ' Days Apart')

axes[1].legend(loc='center left', bbox_to_anchor=(1, 0.5))

fig.tight_layout()

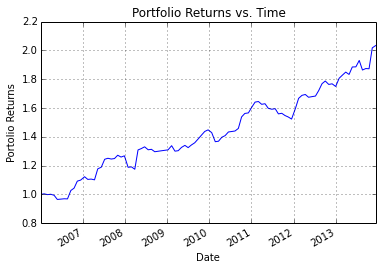

plt.figure()

RETURNS.plot()

plt.xlabel('Date')

plt.ylabel('Portolio Returns')

plt.title('Portfolio Returns vs. Time')

plt.show()

This last plot shows us that using a our approach yielded a portfolio that increased 203%. This is obviously not to be taken too seriously as we know these stocks have done well over the past decade (surivivor bias).